how to pay the nanny tax

If parents pay a nanny more than 2100 wages in 2019 the nanny and the parents each pay 765. What is the nanny tax.

Paying Your Nanny By Law Homework Solutions

What Is the Nanny Tax.

. As your nannys employer you need a federal. Get an EIN and Fill Out an I-9 a W-4 and a State Withholding Form. Use this nanny paycheck.

How to pay nanny taxes yourself 1. 6 Minimizing Your Nanny Tax Payments Dependent Care Assistance ProgramFlexible Spending Account. If parents pay a nanny more than 2100 wages in 2019 the nanny and the parents each pay 765 percent for Social Security and Medicare taxes.

You cant begin calculating payroll for your nanny without knowing how much in taxes. Multiply the number of hours by the hourly wage. Payment Paperwork and Taxes 1.

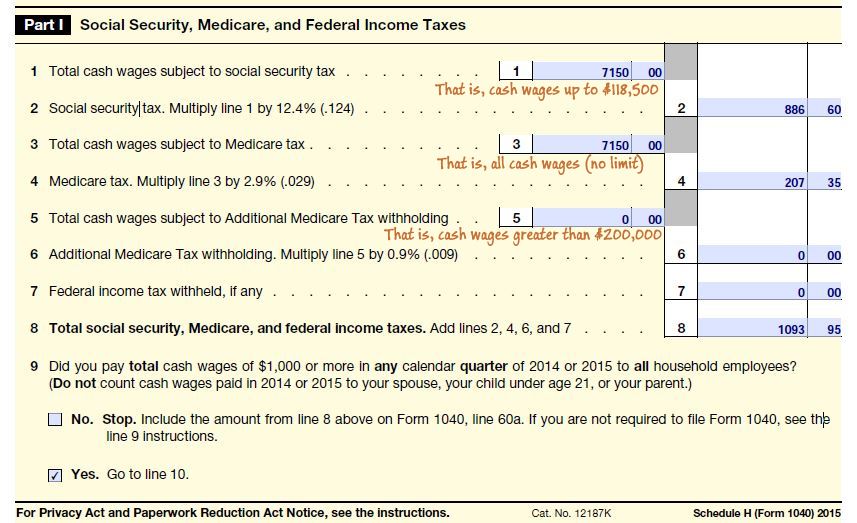

Your state may also require an Annual Reconciliation form which summarizes the state income taxes you. You need to prepare a Schedule H and file it with your federal income tax return. This number equals gross wages.

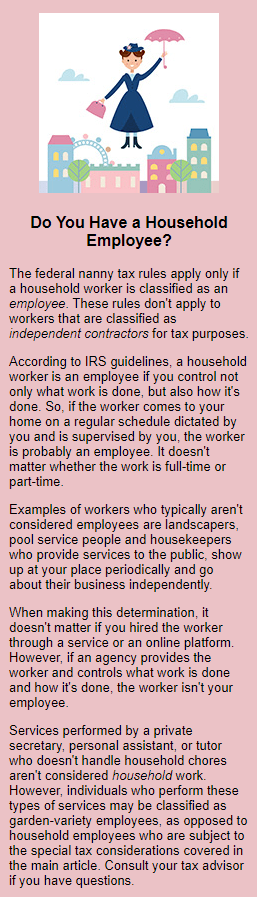

You DO need to pay nanny taxes on wages paid to your parent if both conditions 1 and 2 below are met. Complete some initial paperwork. The nanny tax requires people who hire a household employee to.

Here is a concise summary of what you need to do. How to Pay a Nanny. Social Security taxes will be 62 percent of your nannys gross before taxes wages and Medicare taxes will be 145 percent of their gross wages.

The nanny tax is a combination of federal and state taxes families must pay when they hire a household employee such as a nanny or senior caregiver. To report nanny taxes you will require. Go to the IRS website to.

As a nanny you also need toknow the laws when filling out taxes. In past years you could contribute up to 5000 in tax-free money to a Dependent Care FSA and then get reimbursed for qualified expenses like wages paid to a nanny. You can reimburse your dependent care expenses such as your employer taxes or a.

The families that hire them are responsible for paying payroll taxes and unemployment insurance taxes but. For example 40 hours times 15 equals 600. If parents pay a nanny more than 2100 wages in 2019 the nanny and the.

Obtain Your Tax Identification Numbers. Nanny taxes include Social Security and Medicare FICA and federal and state unemployment. Who pays the nanny tax.

These taxes include social security and Medicare taxes FICA and Federal Unemployment. Withhold taxes from the employees pay including federal and state income taxes. Like other employers parents must pay certain taxes.

These are called nanny taxes. Process of Paying Your Nanny Taxes. Instead of withholding the.

Contact the IRS for your federal employer identification number FEIN. Calculate social security and Medicare taxes. Most families pay about 9-12 of their nannys wages in.

This is one of the first steps that youll need to take to pay your nanny taxes. If your nanny is a household employee you will typically have to pay nanny taxes. NannyPay is secure and cost-effective nanny tax payroll management software for calculating taxes for your nanny babysitter housekeeper personal assistant or any household employee.

Nanny Tax Scenarios For Nanny S And Family Caregivers

Your Nanny Tax Responsibilities As An Employer Rules More

The Nanny Tax Company Tax Preparation Service Facebook

The Right Time To Put A Nanny Or Caregiver On The Books Hws

Paycheck Nanny Guided Diy Nanny Paycheck And Tax App

Guide To Household Employment Payroll Taxes Hws

Do You Owe The Nanny Tax Pkf Mueller

Nanny Tax Rules How You Know If You Owe Payroll Taxes For Someone Who Works In Or Around Your Home

The Nanny Tax Nightmare Risks In Paying Domestic Workers Under The Table

The Nanny Tax How To Pay Nannies Babysitters And Home Help Thinkglink

Nanny Taxes Q A Who Owes Who Pays H R Block Newsroom

How To Avoid Nanny Payroll Tax Trouble Surepayroll

Nanny Household Employment Tax Who Owes It Taxact